Overview

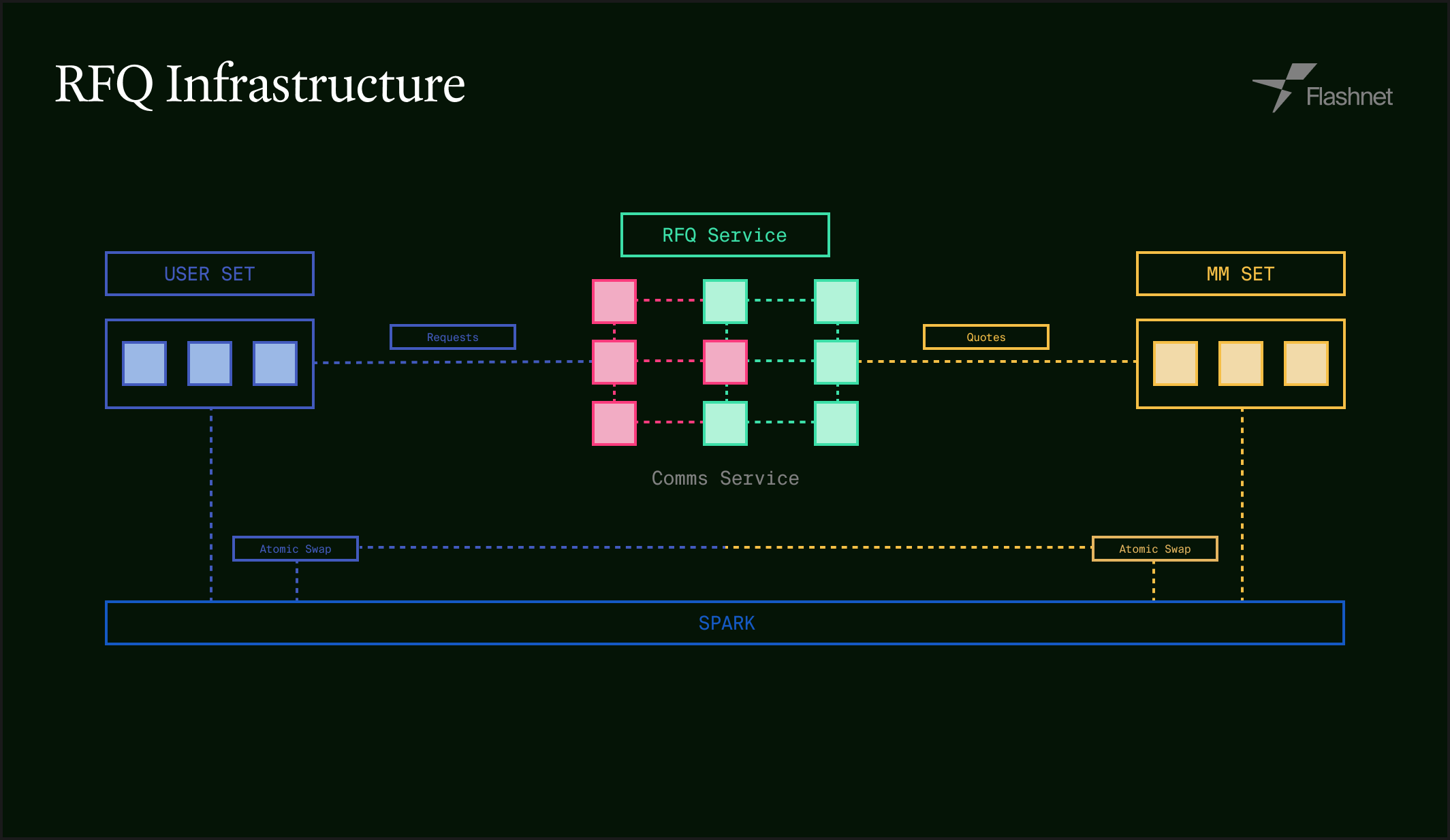

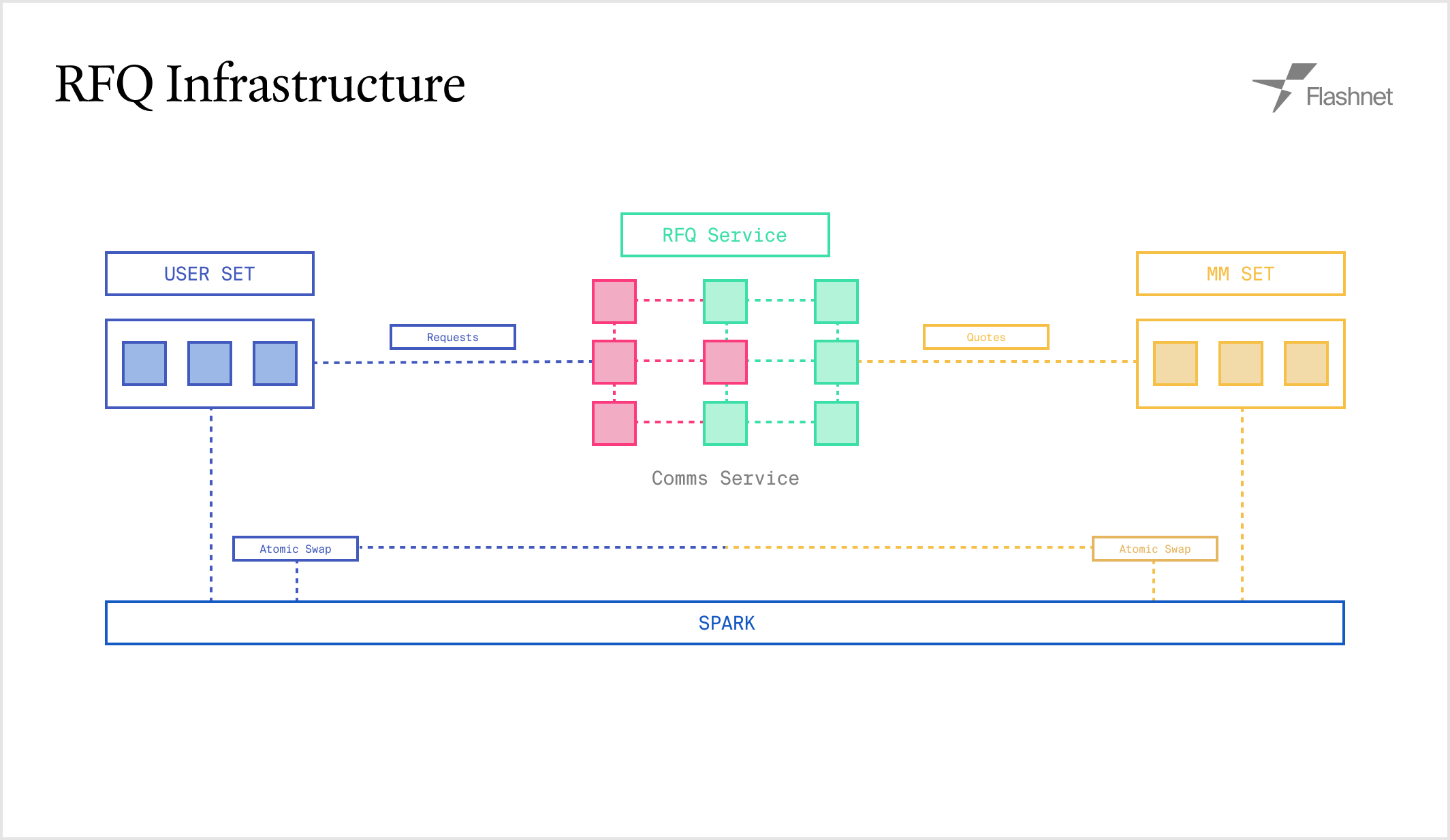

Flashnet RFQ is built on a distributed network of market makers who respond to quote requests with executable atomic swaps on Spark. This design optimizes for best execution of large trades—handling quotes off-chain—while ensuring trustless settlement of native Bitcoin assets through atomic swap primitives. 1. API IntegrationTo provide RFQ functionality, developers integrate the Flashnet RFQ API into their apps. This preserves their brand experience while adding deep liquidity functionality. The API is designed for easy integration, requiring minimal changes or additions to existing applications. 2. Quote Request Process

When a user wants to trade, the application submits a signed RFQ with trade parameters (size, pair, direction). This request includes a leaf specification defining the desired trade. The request is broadcasted to a public channel where multiple market makers compete to provide the best price. 3. Market Maker Competition

Market makers analyze the request and respond with executable quotes, creating atomic swaps on Spark that match the requested parameters. Each quote represents a fully-formed, ready-to-execute trade with a specific price. Applications can optionally include an integrator fee in these quotes, creating a revenue stream. 4. Execution and Settlement

The application receives all quotes and can select the most favorable one based on price or other factors. When a quote is chosen, the application executes the corresponding atomic swap directly on Spark, settling the trade instantly and trustlessly. Funds move directly between the user and market maker without intermediaries.

Why It Matters

This system provides multiple benefits for Bitcoin application developers:- Keep Users in Your Ecosystem: Users never leave your application to access liquidity

- Revenue Opportunities: Custom fee structures and revenue sharing models

- Trustless Execution: No custody or counterparty risk through Spark’s atomic swap primitive

- Deep Liquidity: Access to professional market makers for best execution

- No Market Impact: Execute large trades without moving the market